How crypto-native Africans are shaping the future of digital democracy

Why This Research Matters

Between August 22nd and 25th, 2025, we conducted a groundbreaking survey of 184 Web3 participants through Pax, compensating each respondent 1,500 G$ (~$0.15) via smart contract 0xf0afd9fe2217583187658d96d528ff4fd0340040. What we discovered challenges everything we thought we knew about crypto adoption and voting behavior in Africa.

The results reveal a continent not just participating in Web3, but leading it—with implications that extend far beyond blockchain technology into the future of digital democracy itself.

Understanding Our Sample

Kenya dominates our survey sample with 83.6% representation, providing strong statistical confidence for East African insights, while Nigeria contributes valuable West African perspective at 12.6%.

Our analysis draws from 184 survey responses collected between August 22-25, 2025, through the Pax platform: thepax.app/canvassing.

Earn tokens by completing micro tasks! Download our survey app to get notified about new earning opportunities and start making money instantly. Available on Google Play - scan the QR code or sign in with Google to get started.

Kenya emerged as the dominant force in our research, representing 83.2% of respondents (153 participants), while Nigeria contributed 12.5% (23 participants). The remaining representation includes Tunisia (1.1%), Ghana (1.1%), Indonesia (0.5%), United States (0.5%), and India (0.5%). This East-West African concentration provides unprecedented insights into the continent’s most active crypto communities.

The Demographics Tell a Story

Our survey reveals an extreme gender imbalance, with males representing 85.3% of respondents compared to just 14.1% females—a pattern that significantly influences crypto adoption perspectives.

The demographic profile reveals important considerations for Web3 platform design. With 85.3% male participation versus 14.1% female, our findings highlight a significant gender gap in crypto engagement. This massive imbalance isn’t just a statistical curiosity—it represents both the current reality of crypto adoption and a tremendous untapped opportunity for inclusive Web3 platforms targeting women.

The respondent base is overwhelmingly young, with nearly 69% aged 18-25, indicating exceptionally high receptivity to crypto-based solutions among Africa’s digital-native generation.

The age distribution tells an even more compelling story: 68.9% aged 18-25 (126 respondents), 23.5% aged 26-35 (43 respondents), 5.5% aged 36-45 (10 respondents), and just 2.2% over 46 (4 respondents). With 92.4% under 35, this represents Africa’s digital-native generation, born into mobile connectivity and coming of age during the crypto revolution.

Beyond Beginner: Africa’s Crypto Sophistication

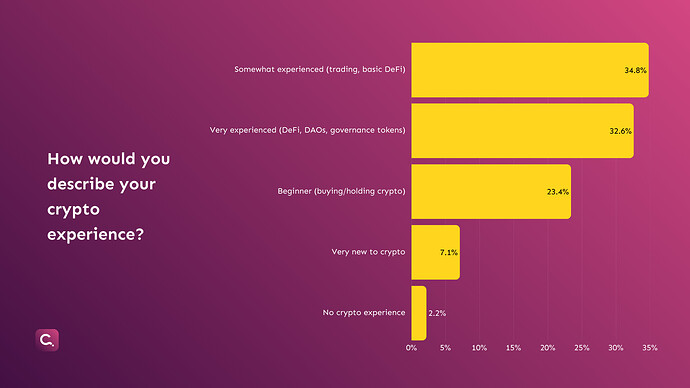

Remarkable crypto sophistication emerges from our data: 67% have meaningful crypto experience, with over 32% being highly experienced in DeFi and governance tokens—far exceeding general population levels.

Despite geographic diversity, crypto sophistication shows exceptional depth. The crypto experience distribution reveals:

-

Somewhat experienced (trading, basic DeFi): 34.8% (64 respondents)

-

Very experienced (DeFi, DAOs, governance tokens): 32.6% (60 respondents)

-

Beginner (buying/holding crypto): 23.4% (43 respondents)

-

Very new to crypto: 7.1% (13 respondents)

-

No crypto experience: 2.2% (4 respondents)

With 67.4% having meaningful crypto experience and 32.6% being highly experienced with governance mechanisms, this represents a crypto-native audience rather than general population, creating ideal conditions for advanced crypto voting platforms.

The Voting Reality: From Theory to Practice

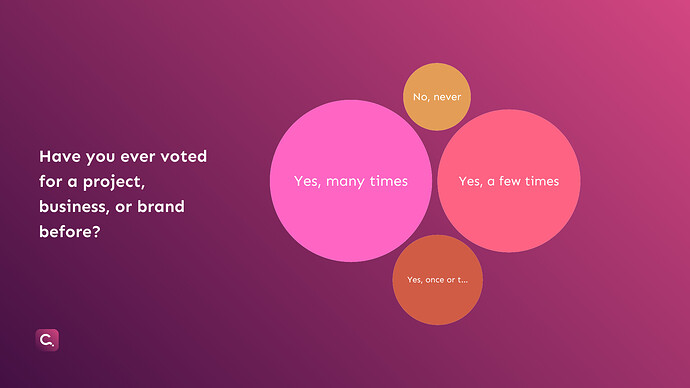

Exceptional online voting engagement: 92% of respondents have previous voting experience, with nearly half being frequent voters, providing a strong behavioral foundation for crypto voting adoption.

While crypto sophistication is impressive, voting behavior reveals the foundation. The voting experience foundation is remarkably solid:

-

Yes, many times: 44.3% (81 respondents)

-

Yes, a few times: 34.4% (63 respondents)

-

Yes, once or twice: 13.7% (25 respondents)

-

No, never: 7.7% (14 respondents)

This means 92.3% have online voting experience, with 78.7% being repeat voters—providing exceptional behavioural foundation for crypto voting platform adoption.

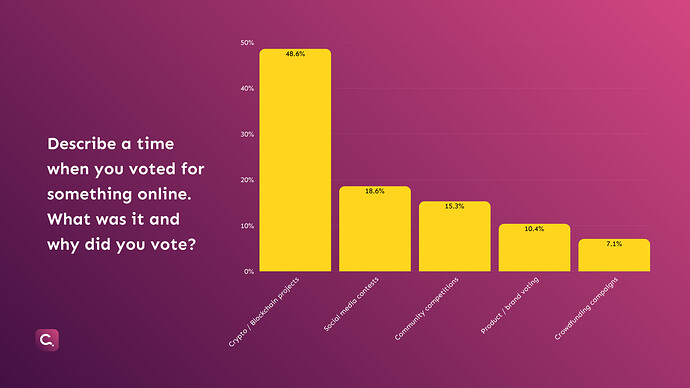

Our analysis reveals crypto/blockchain projects dominate actual voting experiences at 48.6%, indicating this sample represents crypto-engaged users rather than the general population.

Analysis of actual voting contexts reveals crypto dominance. The crypto dominance at 72.9% reveals this isn’t theory—it’s lived experience with blockchain governance at massive scale:

-

Crypto/Blockchain projects: 72.9% (124 responses)

-

Product/brand voting: 10.6% (18 responses)

-

Community competitions/awards: 7.6% (13 responses)

-

Social media contests: 5.3% (9 responses)

-

Crowdfunding campaigns: 1.2% (2 responses)

-

Work/organizational decisions: 1.2% (2 responses)

-

Political/civic voting: 0.6% (1 response)

The Binance Phenomenon

Binance emerges as the dominant voting platform with 21.2% of respondents mentioning it specifically—over 1 in 5 have direct experience with Binance’s token listing votes and governance mechanisms.

Platform-specific mentions reveal Binance’s massive influence:

-

Binance: 21.2% (36 mentions)

-

MiniPay: 3.5% (6 mentions)

-

Canvassing: 2.9% (5 mentions)

-

Telegram: 1.2% (2 mentions)

-

Superfluid: 0.6% (1 mention)

This means over 1 in 5 participants have direct experience with Binance’s token listing votes and governance mechanisms, providing crucial real-world context for crypto voting platform development.

Comprehensive Voting Behavior Analysis

Social media contests lead participation at 76.5%, followed by product/feature voting at 55.2%, indicating high comfort with digital participation mechanisms across various contexts.

Participation across different voting types shows remarkable diversity:

-

Social media contests: 76.5% (140 participants)

-

Product/feature voting: 55.2% (101 participants)

-

Community awards/competitions: 40.4% (74 participants)

-

Work/organization decisions: 28.4% (52 participants)

-

Crowdfunding platform choices: 21.3% (39 participants)

This diversity demonstrates comfort with digital participation across multiple contexts, providing broad behavioural foundation for crypto governance.

Exceptional due diligence: 83.6% check details before voting while 41% vote immediately to help—indicating engaged, cautious voters who prioritize informed decision-making over blind support.

When asked to vote, respondents demonstrate sophisticated behavior:

-

Check what it’s about first: 83.6% (153 participants)

-

Vote immediately to help them: 41.0% (75 participants)

-

Ask friends what they think: 20.8% (38 participants)

-

Ignore the request: 4.4% (8 participants)

-

Feel annoyed by the ask: 1.6% (3 participants)

The combination of high due diligence (83.6%) with significant immediate helpfulness (41.0%) indicates engaged, informed decision-making rather than paralysis or dismissiveness.

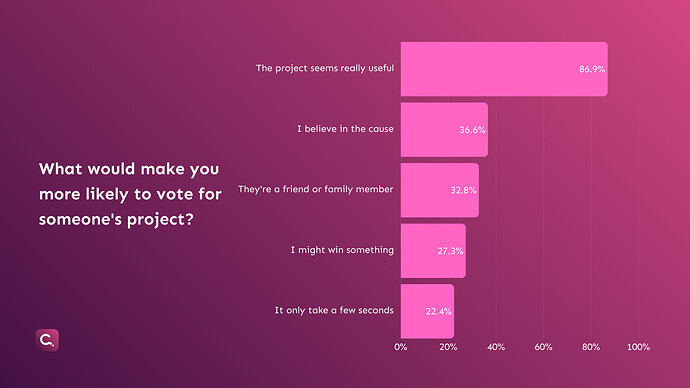

Project utility dominates motivation at 86.9%—indicating a highly rational audience that prioritises project value over personal relationships, convenience, or potential rewards.

Project voting motivators reveal rational priorities:

-

The project seems really useful: 86.9% (159 participants)

-

I believe in the cause: 36.6% (67 participants)

-

They’re a friend or family member: 32.8% (60 participants)

-

I might win something: 27.3% (50 participants)

-

It only takes a few seconds: 22.4% (41 participants)

Utility dominates at 86.9%—nearly 9 in 10 voters prioritize project value over personal relationships (32.8%), potential rewards (27.3%), or convenience (22.4%).

Financial Readiness for Crypto Voting

Financial engagement runs deep: 71.6% have previously put money behind their opinions, with crowdfunding/donations leading at 27.3%, creating strong foundation for token-based voting mechanisms.

Previous financial commitment to opinions shows exceptional readiness:

-

No, never: 28.4% (52 respondents)

-

Yes, crowdfunding / donations: 27.3% (50 respondents)

-

Yes, betting / prediction markets: 25.1% (46 respondents)

-

Yes, buying products I support: 18.0% (33 respondents)

-

Not sure what this means: 1.1% (2 respondents)

With 71.6% having put money behind opinions, and significant participation in prediction markets (25.1%), this audience has proven comfort with financial stakes in outcomes.

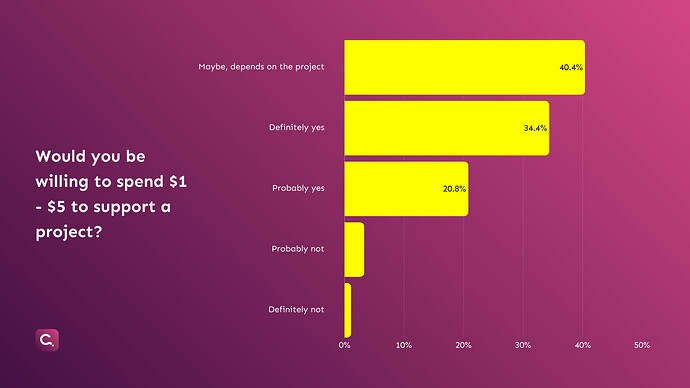

[Insert Spending Willingness Chart]

Overwhelming micro-payment readiness: 95.6% show positive or conditional willingness to spend $1-$5 on projects, with only 4.4% resistant—indicating minimal financial barriers for crypto voting.

Willingness to spend small amounts reveals exceptional readiness:

-

Maybe, depends on the project: 40.4% (74 respondents)

-

Definitely yes: 34.4% (63 respondents)

-

Probably yes: 20.8% (38 respondents)

-

Probably not: 3.3% (6 respondents)

-

Definitely not: 1.1% (2 respondents)

With 95.6% showing positive or conditional willingness and only 4.4% resistant, this creates ideal conditions for low-stake crypto voting mechanisms.

Trust, Barriers, and Platform Challenges

Privacy concerns dominate voting suspicions: 60% worry about personal information requests, while complexity and payment requirements also raise significant trust barriers.

Voting platform suspicions reveal clear trust barriers:

-

Asking for personal information: 68.3% (125 participants)

-

Requiring payment or tokens: 49.7% (91 participants)

-

Too complicated to understand: 38.3% (70 participants)

-

No clear explanation of results: 37.7% (69 participants)

-

Seems like a scam: 34.4% (63 participants)

Privacy concerns dominate (68.3%), while nearly half (49.7%) are suspicious of payment requirements despite expressing willingness to spend—highlighting the need for clear value propositions.

Positive crypto voting reception: 86.3% express curiosity or excitement about token-based voting, with “curious but cautious” leading at 49.7%—indicating strong market potential tempered by prudent skepticism.

Initial reactions to crypto/token voting show strong positivity:

-

Curious but cautious: 49.7% (91 respondents)

-

Excited to try something new: 36.6% (67 respondents)

-

Worried about losing money: 8.7% (16 respondents)

-

Confused about how it works: 4.9% (9 respondents)

With 86.3% expressing curiosity or excitement, and only 13.6% showing concern or confusion, crypto voting has strong receptivity despite general platform suspicions.

What This Means for Web3 Platforms

The findings reveal several fascinating patterns that could reshape how we think about crypto governance in Africa.

The Youth Opportunity: With over 68% of respondents under 25, there’s an incredible opportunity to build governance habits early. But the stark gender gap (85% male participation) suggests we’re missing half the conversation. The massive imbalance represents both current reality and tremendous untapped opportunity for inclusive Web3 platforms targeting women.

Crypto is the Gateway: Nearly 73% already vote in crypto contexts, and 67% have meaningful crypto experience. This isn’t about introducing new concepts - it’s about enhancing what people already do. Web3 platforms can build on existing momentum rather than fighting uphill battles.

Utility Matters More Than We Think: The 86.9% preference for useful projects challenges the assumption that people vote based on relationships or rewards.

Looking Forward: The African Web3 Democracy Future

These findings suggest that Africa is uniquely positioned for Web3 democratic innovation. High crypto sophistication, extensive voting experience, strong altruistic motivations, and exceptional community engagement create ideal conditions for advanced governance mechanisms.

However, success will require nuanced approaches that respect cultural differences, address infrastructure challenges, and provide flexible solutions for diverse technological comfort levels. The key lies not in one-size-fits-all solutions, but in adaptive platforms that can accommodate varying preferences while maintaining consistent democratic participation.

Most importantly, the data suggests that altruistic motivations - not just personal benefits - drive program advocacy. This finding points toward sustainable growth models where utility and community value attract participants, creating advocates who drive organic platform expansion.

Strategic Implications for Web3 Platforms:

-

Africa represents today’s most sophisticated user base, not tomorrow’s opportunity

-

The gender gap is a massive growth opportunity, not just a demographic statistic

-

Simplicity matters even among experts, user experience trumps technical complexity

-

Altruistic motivations drive advocacy, sustainable growth comes from community value

-

Democratic preferences dominate but flexibility is crucial, offer both equal and stake-weighted options

The research reveals that Web3 voting platforms can bridge the gap between crypto experience and democratic participation, creating scalable pathways for meaningful governance innovation across Africa’s diverse markets. As digital democracy evolves, such insights become crucial for designing effective, culturally resonant platforms that leverage blockchain technology for community benefit.

To incentivise participation and demonstrate practical blockchain application, respondents received 1,500 G$ (~$0.15) upon survey completion through smart contract distribution, verifiable at: 0xf0afd9fe2217583187658d96d528ff4fd0340040.

This research was conducted August 22-25, 2025, through Pax (thepax.app/canvassing) with 184 participants across Africa and beyond. The survey was cleaned to remove AI-generated responses and duplicate entries, ensuring authentic human insights.