How African learners are driving demand for practical, risk-free crypto education platforms

Why This Research Matters

Between August 28th and September 1st, 2025, we conducted an extensive survey of 187 crypto learners through Pax, compensating each respondent 0.15 USDT (~$0.15) via smart contract 0x8cf9dccc3e5f9616d231873a576e3bbf179566de. What we discovered reveals Africa’s sophisticated approach to crypto education—one that prioritises practical application, risk management, and community-driven learning.

The results challenge assumptions about crypto education in emerging markets and reveal a continent ready for advanced educational platforms, if designed with the right approach.

Understanding Our Sample

Kenya dominates our survey response with an overwhelming 82.4% representation, providing exceptional statistical confidence for East African market insights, while Nigeria contributes valuable West African perspective at 14.9%.

Our analysis draws from 187 survey responses collected between August 28 - September 1, 2025, through the Pax platform.

Kenya emerges as the dominant force in crypto education demand, representing 82.9% of respondents (155 participants), while Nigeria contributes 15.0% (28 participants). The remaining representation includes Ghana (1.1%), Tunisia (0.5%), and other countries (0.5%). This East-West African concentration provides unprecedented insights into the continent’s most active crypto learning communities, where mobile-first and low-bandwidth solutions are critical.

The Demographics Tell a Story

The crypto education audience shows extreme male dominance at 85%, highlighting significant demographic bias that indicates high receptivity among young male users in African markets.

The demographic profile reveals important considerations for crypto education platform design. With 85.0% male participation versus 15.0% female, our findings highlight a significant gender gap in crypto education engagement. This massive imbalance isn’t just a statistical observation—it represents both the current reality of crypto education engagement and a tremendous untapped opportunity for inclusive platforms targeting women in Africa’s growing digital economy.

Youth concentration is striking, with 68.4% of respondents aged 18-25, creating ideal conditions for digital-first crypto education platforms targeting early adopters in emerging markets.

The age distribution tells a compelling story of generational change: 68.4% aged 18-25 (128 respondents), 24.1% aged 26-35 (45 respondents), 5.9% aged 36-45 (11 respondents), and just 1.6% over 46 (3 respondents). With 92.5% under 35, this represents Africa’s digital-native generation—users who expect mobile-first experiences and interactive learning approaches.

Learning Preferences: Video-First, Hands-On Always

Video content reigns supreme with 83.4% preferring YouTube tutorials, followed closely by hands-on experimentation at 75.9%, indicating strong demand for practical, visual learning approaches.

Despite geographic diversity, learning preferences show exceptional consistency. The learning method preferences reveal clear patterns:

-

YouTube videos or tutorials: 83.4% (156 respondents)

-

Learning by trying things myself: 75.9% (142 respondents)

-

Reading articles and blogs: 68.4% (128 respondents)

-

Taking online courses: 47.6% (89 respondents)

-

Asking friends or experts: 35.8% (67 respondents)

-

Social media (TikTok, Twitter, Instagram): 24.1% (45 respondents)

-

Podcasts or audio content: 17.1% (32 respondents)

Video dominance (83.4%) combined with hands-on experimentation (75.9%) indicates crypto education platforms should prioritise visual tutorials with interactive practice components.

Self-Paced Learning Dominates

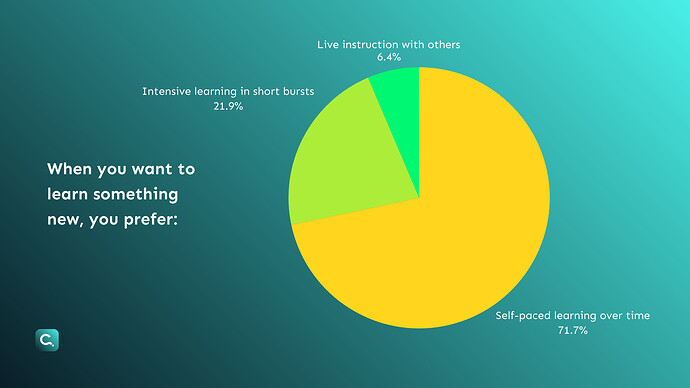

Self-paced learning dominates at 71.7%, perfectly aligning with busy lifestyles common in African markets and suggesting crypto education platforms should prioritize asynchronous, modular content over live sessions.

While crypto sophistication varies, learning pace preferences show remarkable consistency. Learning pace preferences show clear priorities:

-

Self-paced learning over time: 71.7% (134 respondents)

-

Intensive learning in short bursts: 21.9% (41 respondents)

-

Live instruction with others: 6.4% (12 respondents)

This overwhelming preference for self-paced learning aligns with mobile connectivity constraints and work schedules common in African markets, suggesting asynchronous, modular content design is essential.

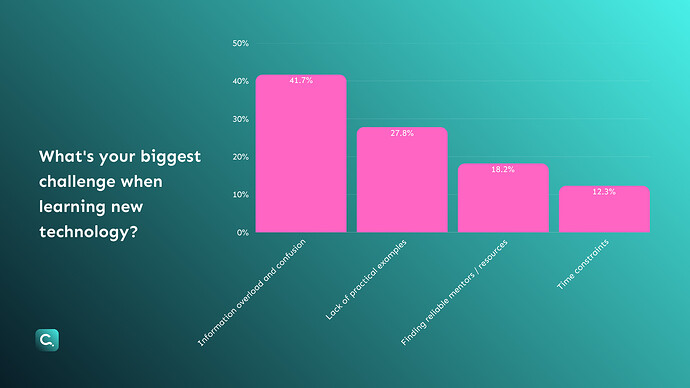

Information overload dominates at 41.7%, reinforcing the critical need for curated, structured learning paths in crypto education platforms to combat confusion and overwhelm.

Technology learning challenges reveal consistent patterns:

-

Information overload and confusion: 41.7% (78 respondents)

-

Lack of practical examples: 27.8% (52 respondents)

-

Finding reliable mentors/resources: 18.2% (34 respondents)

-

Time constraints: 12.3% (23 respondents)

Information overload dominates, reinforcing the need for curated, structured learning paths. The demand for practical examples (27.8%) and mentorship (18.2%) suggests interactive platforms with expert guidance will have significant competitive advantages.

Current Crypto Knowledge Foundation

Strong foundational interest emerges with 47.6% at beginner level, while combined intermediate-to-expert users (49.2%) indicate substantial existing crypto adoption, favoring skill progression over basic awareness.

Current crypto understanding reveals a sophisticated audience:

-

Beginner (heard of it, basic concepts): 47.6% (89 respondents)

-

Intermediate (bought/sold crypto): 27.8% (52 respondents)

-

Advanced (DeFi, staking, yield farming): 15.0% (28 respondents)

-

Expert (could teach others): 6.4% (12 respondents)

-

Complete beginner (know very little): 3.2% (6 respondents)

With 96.8% having at least basic crypto knowledge and 49.2% at intermediate-expert levels, this represents a crypto-aware audience requiring skill progression rather than basic awareness building.

Technical jargon creates the biggest barrier at 67.9%, while financial risk fears at 52.4% and confusion about where to start at 47.6% create substantial friction, demanding plain language and risk-free learning environments.

Crypto learning barriers show clear patterns:

-

Too many technical terms and jargon: 67.9% (127 respondents)

-

Worried about losing money while learning: 52.4% (98 respondents)

-

Don’t know where to start: 47.6% (89 respondents)

-

Too many conflicting opinions online: 40.6% (76 respondents)

-

Information seems outdated quickly: 24.1% (45 respondents)

-

Don’t see practical benefits: 12.3% (23 respondents)

Technical jargon dominates barriers (67.9%), while financial risk fears (52.4%) and information overwhelm (47.6%) create substantial friction, demanding plain language explanations with risk-free learning environments.

Content Reception and Platform Preferences

Predominantly positive reception emerges with 47.6% getting excited and 35.8% feeling cautious but interested, indicating an engaged but prudent audience requiring confidence-building measures in education design.

Reactions to crypto content show overwhelmingly positive engagement:

-

Get excited and want to learn more: 47.6% (89 respondents)

-

Feel cautious but interested: 35.8% (67 respondents)

-

Feel overwhelmed by complexity: 12.3% (23 respondents)

-

Skip it entirely: 4.3% (8 respondents)

With 83.4% showing interest or excitement, and only 16.6% expressing overwhelm or avoidance, the audience demonstrates strong receptivity requiring confidence-building rather than awareness-building approaches.

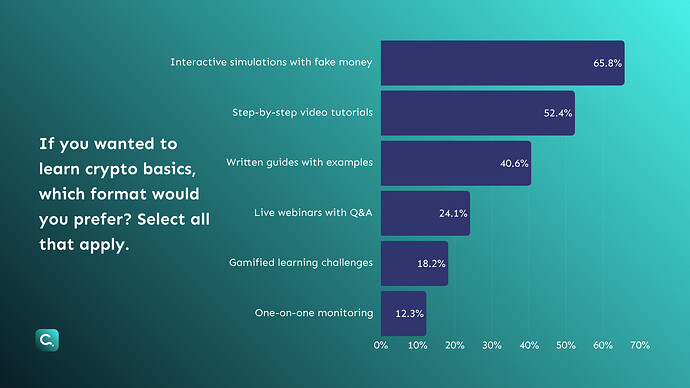

Simulation-based learning dominates preferences at 65.8%, confirming overwhelming demand for risk-free practice environments, followed by video tutorials at 52.4% and written guides at 40.6%.

Preferred crypto education formats reveal clear priorities:

-

Interactive simulations with fake money: 65.8% (123 respondents)

-

Step-by-step video tutorials: 52.4% (98 respondents)

-

Written guides with examples: 40.6% (76 respondents)

-

Live webinars with Q&A: 24.1% (45 respondents)

-

Gamified learning challenges: 18.2% (34 respondents)

-

One-on-one mentoring: 12.3% (23 respondents)

Simulation-based learning dominates (65.8%), confirming demand for risk-free practice environments. The combination with video tutorials (52.4%) suggests platforms should integrate visual instruction with hands-on practice.

What Makes Crypto Education Appealing

Relatable examples dominate at 77.5% alongside risk-free learning at 71.7%, establishing these as critical success factors, while beginner-friendly paths at 66.3% emphasize the need for zero-start learning journeys.

Crypto education appeal factors show clear success requirements:

-

Real-world examples I can relate to: 77.5% (145 respondents)

-

No financial risk while learning: 71.7% (134 respondents)

-

Learning path that starts from zero: 66.3% (124 respondents)

-

Immediate practical applications: 52.4% (98 respondents)

-

Community support and discussion: 46.5% (87 respondents)

-

Certificates or badges for completion: 35.8% (67 respondents)

Relatable examples (77.5%) and risk-free learning (71.7%) emerge as critical success factors, while beginner-friendly paths (66.3%) emphasize the need for comprehensive foundational content.

Time Investment and Platform Trust

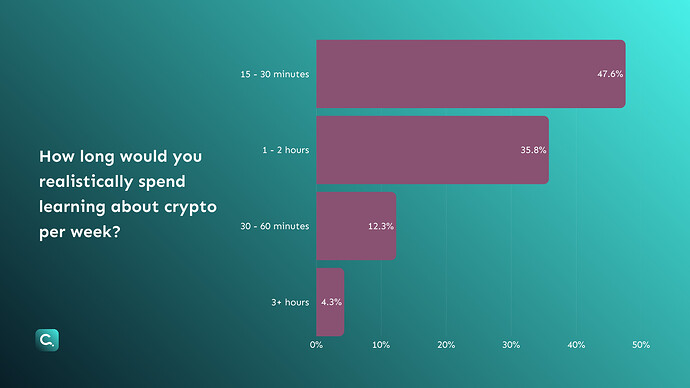

Moderate time commitment prevails with 47.6% willing to dedicate 15-30 minutes weekly and 35.8% willing to invest 1-2 hours, suggesting bite-sized, modular content design is optimal for this audience.

Weekly time investment preferences show moderate commitment levels:

-

15-30 minutes: 47.6% (89 respondents)

-

1-2 hours: 35.8% (67 respondents)

-

30-60 minutes: 12.3% (23 respondents)

-

3+ hours: 4.3% (8 respondents)

With nearly half (47.6%) willing to dedicate 15-30 minutes weekly and over one-third (35.8%) willing to invest 1-2 hours, bite-sized modular content with optional deep-dive sessions appears optimal.

Risk-free practice environments at 75.9% and peer validation at 68.4% emerge as essential trust builders, while expert credibility at 52.4% and free access at 46.5% serve as important secondary factors.

Trust requirements for crypto education platforms show clear priorities:

-

Offers practice with fake money first: 75.9% (142 respondents)

-

Has good reviews from other learners: 68.4% (128 respondents)

-

Created by well-known crypto experts: 52.4% (98 respondents)

-

Free to access basic content: 46.5% (87 respondents)

-

Transparent about content creators: 40.6% (76 respondents)

-

Endorsed by financial institutions: 24.1% (45 respondents)

Risk-free practice environments (75.9%) and peer validation (68.4%) emerge as essential trust builders, while expert credibility matters more than institutional endorsement.

Overcoming Fear: The Psychological Barriers

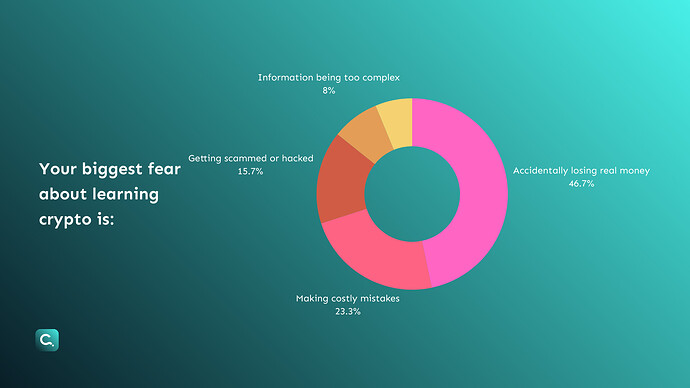

Financial loss fears dominate at 46.7%, reinforcing the critical importance of simulation-based learning environments, while security concerns at 15.7% and complexity anxiety require robust safety education and simplified interfaces.

Primary fears about crypto learning reveal psychological barriers:

-

Accidentally losing real money: 71.7% (134 respondents)

-

Making costly mistakes: 35.8% (67 respondents)

-

Getting scammed or hacked: 24.1% (45 respondents)

-

Information being too complex: 12.3% (23 respondents)

-

Wasting time on outdated info: 9.6% (18 respondents)

Financial loss dominates fears (71.7%), reinforcing the critical importance of simulation-based learning environments. Security concerns (24.1%) and complexity anxiety (12.3%) require robust safety education and simplified interfaces.

What This Means for Crypto Education Platforms

The findings reveal several fascinating patterns that could reshape how we think about crypto education in Africa.

The Youth Opportunity: With over 68% of respondents under 25, there’s an incredible opportunity to build crypto literacy habits early. But the stark gender gap (85% male participation) suggests we’re missing half the conversation. Women often make community and household decisions - engaging them could dramatically amplify impact.

Video-First, Hands-On Always: The 83.4% preference for YouTube tutorials combined with 75.9% wanting hands-on practice isn’t coincidental. This generation learns by watching then doing - crypto education platforms must integrate both seamlessly.

Safety Above All: The 71.7% fear of losing money while learning, combined with 75.9% demand for practice environments, shows this isn’t about technical complexity - it’s about psychological safety. Risk-free simulation environments aren’t nice-to-have features, they’re essential for adoption.

Community-Driven Growth: The 47.6% preference for post-learning community engagement suggests sustainable platforms create ongoing value, not just one-time educational content.

Looking Forward: The African Crypto Education Future

These findings suggest that Africa is uniquely positioned for crypto education innovation. High existing crypto awareness, strong preferences for practical learning, and community-oriented post-education engagement create ideal conditions for sophisticated educational platforms.

However, success will require nuanced approaches that respect connectivity constraints, address financial risk fears, and provide culturally relevant examples. The key lies not in simplified content, but in sophisticated platforms that make complex concepts accessible through simulation, community support, and expert guidance.

Most importantly, the data suggests this isn’t about bringing crypto education to Africa - it’s about serving a sophisticated, demanding audience that’s already actively seeking advanced crypto knowledge.

Strategic Implications for Crypto Education Platforms:

-

Africa represents today’s most engaged crypto learning market, not tomorrow’s opportunity

-

The gender gap is a massive growth opportunity, not just a demographic statistic

-

Simulation environments are essential, not optional features

-

Community features drive retention, one-time education content isn’t enough

-

Mobile-first design is critical, but don’t compromise on sophistication

The research reveals that crypto education platforms can bridge the gap between high crypto awareness and practical application skills, creating scalable pathways for meaningful Web3 participation across Africa’s diverse markets. As crypto adoption evolves, such insights become crucial for designing effective, culturally resonant platforms that leverage blockchain technology for economic empowerment.

To incentivise participation and demonstrate practical blockchain application, respondents received 0.15 USDT (~$0.15) upon survey completion through smart contract distribution, verifiable at: 0x8cf9dccc3e5f9616d231873a576e3bbf179566de.

This research was conducted August 28 - September 1, 2025, through Pax (thepax.app/canvassing) with 187 participants across Africa and beyond. The survey was cleaned to remove AI-generated responses and duplicate entries, ensuring authentic human insights.