[REPORT] Blockchain Knowledge Assessment: Cultural and Regional Perspectives from Nigeria and Kenya

Cultural and Regional Perspectives on Blockchain Technology Adoption in East and West Africa

The blockchain revolution in Africa is unfolding at different paces and with varying levels of understanding across the continent. A recent study comparing blockchain knowledge among MiniPay users in Nigeria and Kenya reveals fascinating insights into how these two influential markets are approaching this transformative technology while maintaining their unique regional characteristics.

Why This Research Matters

Understanding the nuanced differences in blockchain comprehension across African markets is critical for several reasons. First, as blockchain-based financial services expand across the continent, region-specific insights help ensure solutions are properly understood and practically useful. Second, the findings can guide blockchain education efforts by highlighting knowledge gaps unique to each market. Finally, these insights help bridge the gap between technical implementation and user understanding, potentially accelerating adoption while respecting local learning preferences.

This research specifically examines Nigeria and Kenya—two markets often viewed as digital finance leaders in Africa, but which demonstrate distinctly different levels of blockchain literacy. By comparing these contrasting knowledge landscapes, we gain valuable insights applicable to blockchain education and implementation in other emerging markets worldwide.

Understanding the Markets

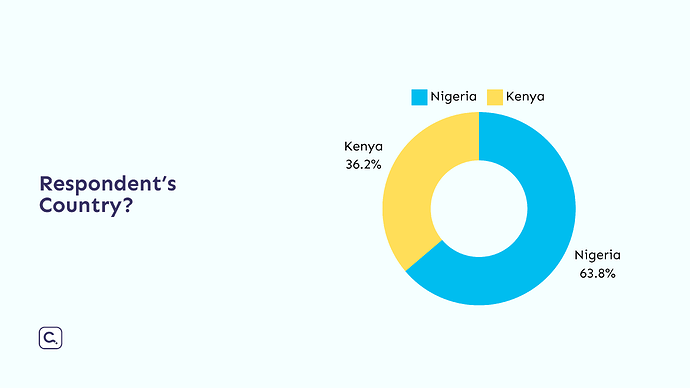

Survey demographics show majority of respondents from Nigeria (63.8%) with Kenya representing 36.2% of participants.

Our analysis draws from a comprehensive survey of 47 MiniPay users, with 63.8% from Nigeria and 36.2% from Kenya. While Nigeria represents the larger sample, both markets provide valuable insights into their respective regions: West Africa and East Africa.

Blockchain Knowledge Fundamentals

Overall blockchain knowledge levels reveal strong foundational understanding with opportunities for deeper technical education.

The contrast in blockchain comprehension between these markets tells a compelling story. Kenya shows consistently higher blockchain literacy with 100% having at least a basic understanding, while 30% of Nigerian respondents have minimal or no blockchain knowledge. Here’s what stands out:

-

Kenya shows a significantly higher percentage of respondents (35.3%) with deep blockchain understanding compared to Nigeria (23.3%).

-

Nearly half (46.7%) of Nigerian users have a basic grasp of blockchain as a digital ledger.

-

Notably, 20% of Nigerian respondents have heard the term blockchain but remain unsure of what it means, compared to 0% in Kenya.

-

A small but significant portion (10%) of Nigerian users report no knowledge of blockchain at all.

This knowledge disparity suggests different approaches may be needed for product education and onboarding in each market.

Stablecoin Awareness and Understanding

Comparing stablecoin familiarity in Nigeria and Kenya: Nigerians show greater awareness across all categories, with a significant gap in those who fully understand stablecoin mechanisms.

Stablecoin familiarity, critical for users of a platform like MiniPay, shows interesting regional variations:

-

Kenya demonstrates more sophisticated understanding of stablecoins with 52.9% fully understanding their parity mechanism versus 40% in Nigeria.

-

A comparable proportion in both countries (36.7% Nigeria, 29.4% Kenya) know stablecoins are tied to regular currencies without fully understanding the mechanics.

-

No Kenyan respondents reported complete unfamiliarity with stablecoins, while 6.7% of Nigerians had never heard of them.

This suggests education efforts might prioritize different aspects of stablecoins in each market.

Blockchain Discovery and Recognition

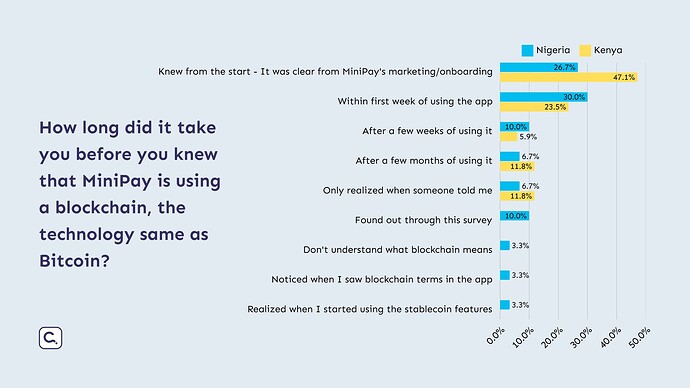

Timeline of blockchain awareness among MiniPay users reveals significant differences in when users realized the app operated on blockchain technology.

One particularly revealing question explored how long it took users to realize MiniPay was using blockchain technology:

-

Nearly half of Kenyan users (47.1%) recognized MiniPay as blockchain-based from the start compared to only 26.7% of Nigerians.

-

A significant proportion in both countries discovered this connection within the first week (30% Nigeria, 23.5% Kenya).

-

Notably, 10% of Nigerian users first learned about the blockchain connection through this survey itself, suggesting a significant awareness gap between the markets.

These findings highlight important differences in how blockchain technology is recognized and understood across regions.

Technical Understanding and Comprehension

Network Fees Understanding

Understanding of blockchain network fees varies considerably between Nigerian and Kenyan MiniPay users, with strong comprehension of network validation across both markets.

Understanding of blockchain network fees—a critical element of transaction costs—varies interestingly:

-

Nigerian respondents show stronger understanding of blockchain network fees with 70% correctly identifying their purpose versus 58.8% in Kenya.

-

However, Kenya has a higher proportion (35.3%) with partial understanding compared to Nigeria (16.7%).

-

A small percentage in both countries (6.7% Nigeria, 5.9% Kenya) don’t understand why digital transfers need fees.

-

6.7% of Nigerian respondents were unfamiliar with the concept of network fees altogether.

Blockchain Wallet Comprehension

Users demonstrate varied comprehension of blockchain wallet functionality, with most understanding basic concepts of digital asset storage.

Wallet knowledge, fundamental to secure blockchain usage, shows significant regional variation:

-

Kenyan users demonstrate more than twice the technical understanding of blockchain wallets (41.2% with clear cryptography knowledge) compared to Nigerians (20%).

-

The majority in both countries understand that wallets store digital assets somehow (66.7% Nigeria, 58.8% Kenya).

-

Small percentages of Nigerian respondents either think blockchain wallets are like regular digital wallets (6.7%) or have no understanding at all (6.7%), while no Kenyan respondents fell into these categories.

Blockchain Address Literacy

Blockchain address comprehension reflects different levels of technical understanding across Nigerian and Kenyan MiniPay users.

The technical understanding of blockchain addresses—critical for sending and receiving assets—reveals perhaps the most striking knowledge disparity:

-

Kenyan respondents show significantly higher technical understanding of blockchain addresses with 64.7% recognizing their cryptographic nature compared to only 26.7% in Nigeria.

-

More than half (56.7%) of Nigerian respondents understand addresses as “account numbers for blockchain” compared to 35.3% in Kenya.

-

10% of Nigerian respondents incorrectly view blockchain addresses as similar to email addresses, while no Kenyan respondents held this misconception.

-

6.7% of Nigerian users report no knowledge of blockchain addresses.

These findings highlight critical educational opportunities for improving secure transaction practices.

Advanced Blockchain Concepts

Transaction Irreversibility

User knowledge about blockchain’s immutable transaction nature reveals both technical understanding and misconceptions across markets.

One of blockchain’s most important security features—transaction irreversibility—is understood differently across markets:

-

Kenyan respondents demonstrate better understanding of blockchain transaction irreversibility with 58.8% understanding the technical reason versus 40% in Nigeria.

-

Equal proportions in Nigeria (40%) know transactions can’t be reversed but don’t understand why, compared to 29.4% in Kenya.

-

10% of Nigerian respondents have the potentially problematic misconception that blockchain transactions can be reversed, while no Kenyan respondents held this view.

This knowledge gap has significant implications for user security and transaction confidence.

Consensus Mechanisms

Understanding of blockchain consensus mechanisms varies widely, with Kenyan users showing stronger familiarity with proof of work concepts.

Understanding of consensus mechanisms—how blockchains validate transactions—shows one of the largest knowledge disparities:

-

Kenyan respondents show significantly more advanced understanding with 82.4% understanding at least the basic function versus only 56.6% of Nigerians.

-

A striking third of Nigerian respondents (33.3%) have no knowledge of consensus mechanisms compared to just 5.9% in Kenya.

-

Technical understanding of proof of work/stake differences is nearly double in Kenya (41.2%) compared to Nigeria (23.3%).

Blockchain Security Perception

Security perceptions reflect both confidence and caution, with users across both countries prioritizing verification practices.

Security perception reveals different approaches to trust in blockchain systems:

-

Kenyan users demonstrate more than double the technical understanding of blockchain security (52.9% understanding cryptographic principles) compared to Nigerians (23.3%).

-

Nigerian users are more likely to “always double-check” transactions (43.3%) compared to Kenyans (29.4%), suggesting a more cautious approach.

-

All Kenyan respondents show at least some understanding of blockchain security concepts, while 16.7% of Nigerian respondents have misconceptions or no understanding.

Ecosystem Awareness and Future Outlook

Smart Contracts Understanding

Smart contract comprehension levels indicate growing awareness of automated blockchain processes among MiniPay users.

Smart contract comprehension, crucial for understanding blockchain’s programmability:

-

Kenyan respondents demonstrate more than twice the level of detailed smart contract knowledge (47.1% with clear understanding) compared to Nigerians (20%).

-

The majority of Nigerian respondents (53.3%) know smart contracts automate blockchain processes somehow, compared to 35.3% in Kenya.

-

All Kenyan respondents had at least heard of smart contracts, while 10% of Nigerians had never encountered the term.

Multi-Blockchain Knowledge

Blockchain ecosystem knowledge shows strong familiarity with major networks while revealing educational opportunities around blockchain diversity.

Knowledge of the broader blockchain ecosystem shows significant differences:

-

Kenyan respondents show significantly higher knowledge with 70.6% familiar with multiple chains and their differences versus only 40% in Nigeria.

-

Nigerian respondents are more likely to know only a few major blockchains like Bitcoin/Ethereum (43.3%) compared to Kenyans (17.6%).

-

Small percentages in both countries had either only heard of Bitcoin or didn’t know different blockchains existed.

Learning Journey with MiniPay

MiniPay usage has driven varied levels of blockchain education, with significant improvements reported particularly among Kenyan users.

The impact of using MiniPay on blockchain understanding varies between markets:

-

A larger percentage of Kenyan respondents (29.4%) reported significant improvements in blockchain understanding compared to Nigerians (16.7%).

-

Notably, 11.8% of Kenyan respondents indicated they were already knowledgeable about blockchain before using MiniPay, while no Nigerian respondents claimed prior expertise.

-

A large portion of Nigerian responses (60%) were categorized as “Other/Unclear,” suggesting potential challenges in measuring learning progress.

User Preferences and Future Features

Feature preferences highlight demand for expanded cryptocurrency support and cross-chain functionality in Kenya’s MiniPay ecosystem.

Nigerian users prioritize additional cryptocurrency support and cross-chain functionality among desired blockchain enhancements for MiniPay.

Desired blockchain features reflect different regional priorities:

Kenya Feature Interests:

-

Gaming/betting integration (23.5%)

-

Cryptocurrency support beyond stablecoins (17.6%)

-

Cross-chain functionality (5.9%)

-

Lower gas fees (5.9%)

-

Mobile money integration (5.9%)

Nigeria Feature Interests:

-

Additional cryptocurrency support (23.3%)

-

Cross-chain/multi-protocol support (16.7%)

-

Transaction confirmation improvements (3.3%)

-

P2P functionality (3.3%)

-

Multi-fiat conversion (3.3%)

Both countries show strong interest in expanded cryptocurrency support beyond stablecoins, but Nigerian respondents place more emphasis on cross-chain interoperability, while Kenyan respondents show unique interest in gaming/betting integrations and mobile money connections, reflecting different regional use case priorities.

Looking Ahead

These findings suggest several key considerations for blockchain platforms and educators:

-

Market-Specific Education: One-size-fits-all educational approaches are unlikely to succeed across both markets.

-

UI/UX Design: Interface design should account for varying levels of technical understanding.

-

Feature Prioritization: Development roadmaps might prioritize different features in each market.

-

Security Communication: Efforts to communicate security best practices should be tailored to current understanding levels.

-

Community Building: Educational communities might focus on different aspects of blockchain in each region.

The blockchain knowledge landscape in Africa continues to evolve, with Kenya and Nigeria showing different but equally valid paths to blockchain literacy. Understanding these differences and similarities is crucial for any organization looking to contribute to Africa’s blockchain future.

Methodology and Data Collection

This analysis draws from survey data collected specifically among MiniPay users in Nigeria and Kenya between February 10th and February 28th, 2025. MiniPay, a dollar stablecoin wallet built on the Celo blockchain, provided a unique opportunity to study blockchain knowledge among users already engaging with blockchain-based financial tools. To incentivize participation and demonstrate the practical application of blockchain technology, participants received 0.1 cUSD (Celo Dollar) as a reward upon completion and claiming of the survey. This reward distribution was handled through a smart contract, which can be verified at: 0x3D45B2efB2a664fE63521435360568f64D906485.

This participant selection provides an interesting lens through which to view the data, as these users represent early adopters of blockchain-based currency solutions while demonstrating varying levels of understanding of the underlying technology. The total sample included 47 respondents across both countries, focusing on blockchain comprehension, technical understanding, and desired features.

It’s worth noting that this sample represents users who are already using blockchain technology (even if unknowingly), which may influence their perspectives. However, the significant variations in understanding levels still provide valuable insights for blockchain education and implementation strategies across different African markets.

For more information about our project, please visit our website. This project has also been published on Medium.

This blog post was drafted with the assistance of AI technology and was reviewed and edited by our research team.