In Q3 2025, our focus was on innovation that matters. Removing friction, expanding access, and deepening the ways stablecoins can be used in daily life.

By the Numbers (Q3 2025)

By the Numbers (Q3 2025)

Septemer 2025, made it officially 2 years since we launched MiniPay. Read more about the road so far here.

-

10M+ total wallet activations

-

280M+ transactions processed

-

Live in 60+ countries, with strong momentum across SEA

-

Regional momentum: activations surged 860% in South Africa over the past year, while usage in the U.S. grew 20x and Europe and Asia tripled.

Major Product Launches

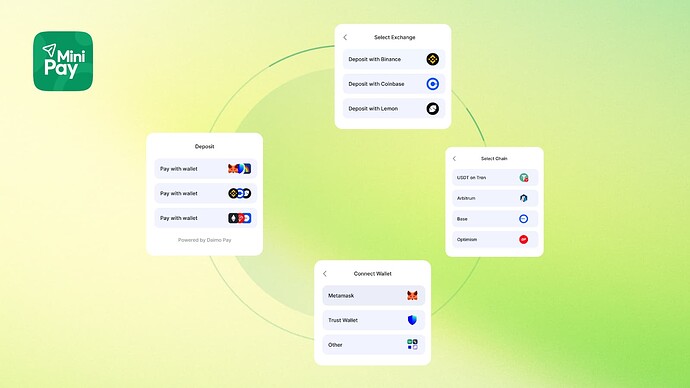

Cross-Chain Deposits

Interoperability has always been a hard requirement. This quarter we made a major leap in making MiniPay truly chain-agnostic. Back in June we enabled withdrawals to exchanges, giving users more freedom to move out of MiniPay. In Q3, we went a step further, launching cross-chain deposits powered by Daimo Pay. First asa Mini App and then integrated natively, this update lets users bring assets from 10+ chains and 1200+ tokens directly into MiniPay, instantly converted to stablecoins.

Why it matters:

-

Unlocking liquidity: users can move stablecoins they already hold on other chains into MiniPay in just three taps

-

Easier onboarding: no need to understand bridging, token swaps, or gas fees to move to stablecoins on Celo

-

Expanding fiat access: the easier it is to move assets in, the easier it becomes to cash out via MiniPay’s robust partner network.

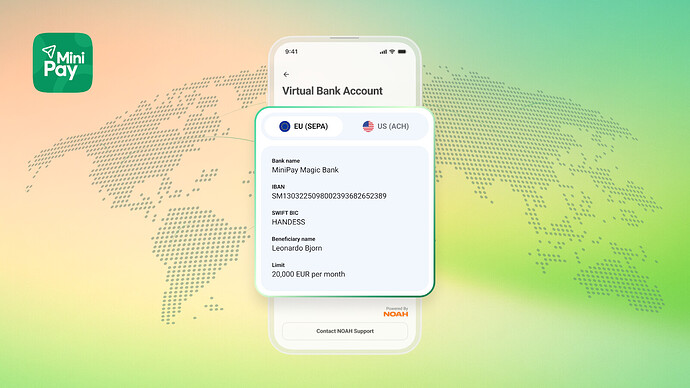

Virtual Accounts (USD & EUR)

Another milestone was the launch of virtual US and EU accounts, teased at our EthCC side event in July. Users can now request ACH or SEPA account details in their own name, enabling seamless inbound transfers. Funds arrive instantly as stablecoins, with no fees thanks to our partnership with Noah.

Why it matters:

-

Global rails for freelancers: professionals in LATAM, SEA, and Africa can now get paid like they had a US/EU account, and withdraw to local currency (or spend on utilities) with ease.

-

Simpler onramps for crypto users: for US and EU users, a local bank transfer is all it takes to go from fiat to USDT, USDC, or cUSD.

-

No more “Not available in your country”: with freelancer economies booming in underserved regions, MiniPay is uniquely positioned to provide global professionals with money rails that just work.

MiniPay Discover: Web3’s App Store Moment

Mini Apps have reached escape velocity. In Q3, the ecosystem generated about 8 million daily impressions and over 16 million monthly app opens, a scale that rivals early mobile app store traction. From a pilot of three apps, MiniPay now hosts everything from utilities and bill payments to on-chain rewards and microwork.

We redesigned the Mini Apps page to make discovery more intuitive, adding two features that drive both user experience and developer success:

-

Deeplinking: Mini Apps can send users directly from social or community channels into specific app pages, amplifying marketing campaigns.

-

App Favourites: users can pin the apps they rely on most, cutting friction and boosting engagement.

Why it matters:

-

Mini Apps are generating massive engagement, showing demand across diverse categories.

-

Breakout apps like BitGifty, Bando, and eSIM are proving stablecoins can power real-world services at scale.

Strategically, Mini Apps are transforming MiniPay from a wallet into a distribution platform for Web3 apps, much like the iOS App Store unlocked mobile software.

Enhanced Cross-Border Transfers

Remittances remain one of MiniPay’s most mission-aligned use cases. In Q3, we refined our flows to address user pain points identified in focus groups and agent interviews. Currency options are now explicitly surfaced, with clearer visibility into where funds are headed.

Why it matters:

-

Frequent remitters: improved transparency builds confidence in repeat use.

-

Crypto-curious users: simpler flows reduce intimidation and make first-time use easier.

-

New corridors: creates the foundation to expand into markets where informal P2P channels dominate.

Stablecoins as Real-World Currency

A major milestone this quarter was the growth of stablecoin utility beyond speculation or savings. Utility Mini Apps that allow users to “Pay with MiniPay” now process hundreds of thousands of transactions every month spanning products like airtime, data, vouchers, and gift cards.

Why it matters:

-

Everyday money: apps like BitGifty and Bando are proving that stablecoins can be used for real-world purchases at scale.

-

From asset to currency: through MiniPay, stablecoins are starting to function like real currencies — liquid, transferable, and practical.

-

Powered by performance: Celo’s one-block finality makes this possible at ~1-second settlement and fees as low as $0.001, making small-dollar payments viable where legacy rails fail.

MiniPay’s Road to Zero Fees

High ramp fees have long been a barrier to adoption. In Q3, MiniPay advanced its Road to Zero Fees initiative, now including 8 on/off-ramp providers to eliminate costs across major global and regional payment methods including cards, bank transfers, PIX, GCash, mobile money, Apple Pay, and Google Pay.

Why it matters

-

In the US and EU, where fees previously discouraged small-volume adoption, conversion rates are rising.

-

Repeat purchases are growing, as users return to MiniPay for its low-cost liquidity.

-

Increasingly, users are bringing assets into MiniPay specifically to cash out — treating it as the preferred liquidity hub.

-

Broader coverage: with 15+ partners supporting 40 local currencies, average cash-in times are now just 55 seconds. Covering everything from Apple Pay in the U.S. to M-PESA and GCash across Africa and Asia.

On-the-Ground: MiniPay at EthCC

On-the-Ground: MiniPay at EthCC

MiniPay strengthened its presence in the ecosystem and wider community with an on-the-ground push at EthCC. Co-hosting a booth with Mento as well as hosting a side event in Cannes, we previewed Virtual Accounts, Pay with MiniPay, and connected directly with builders, partners, and the broader ecosystem.

Why it matters:

-

Reinforced MiniPay as the layer where Web3 and real-world finance converge.

-

Showcased MiniPay’s role as a partner for builders developing the next wave of decentralized apps.

On-the-Ground: Accra & Magma Summit

On-the-Ground: Accra & Magma Summit

This quarter, the team spent time in Accra, Ghana, as part of MiniPay’s broader effort to win remittance corridors one market at a time. Our focus was on understanding how money actually moves on the ground, particularly in regions where informal agents remain the backbone of cross-border exchange.

We also joined the Magma Summit, connecting with ecosystem builders, local operators, and fintech innovators shaping Africa’s digital economy. Beyond the conference, we held focus groups and interviews with P2P agents and users to map how MiniPay fits naturally into existing financial behaviors.

These insights are now informing early tests across key corridors with Ghana, where we’re localizing campaigns and refining product flows to better serve users who rely on community-based money transfer networks.

What’s Ahead for Q4 into 2026

What’s Ahead for Q4 into 2026

![]() Running targeted builder campaigns to bring more Mini Apps and integrations into the ecosystem.

Running targeted builder campaigns to bring more Mini Apps and integrations into the ecosystem.

![]() Continuing product updates and global market expansion to consolidate MiniPay’s position as the most usable stablecoin wallet worldwide.

Continuing product updates and global market expansion to consolidate MiniPay’s position as the most usable stablecoin wallet worldwide.

Calling All Builders

Calling All Builders

MiniPay is becoming the go-to distribution layer for stablecoin-powered apps. If you’re building a real-world use case, we can help you reach the users you need—at scale.

Big thanks to the community for being part of the journey. MiniPay is making stablecoins usable everywhere, for everyone.