Creating the Next FX Market: A Strategy to Attract Liquidity to Celo

TL;DR

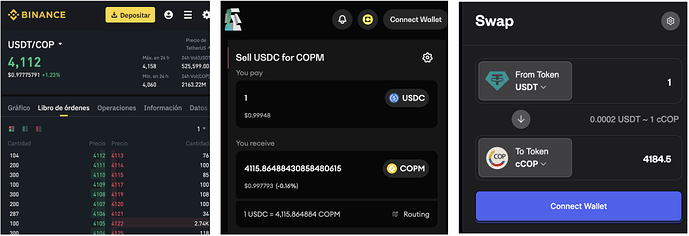

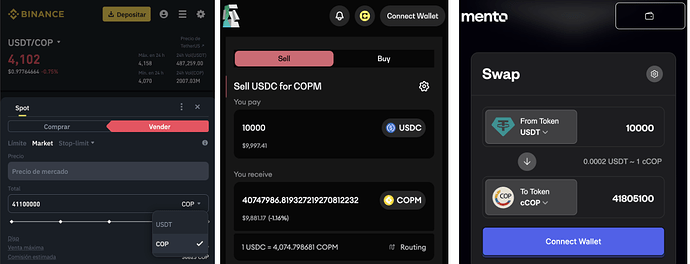

Celo has made significant progress in local stablecoin adoption (cCOP, cREAL, BRLA), but its FX markets remain inefficient. Price gaps between CEXs and CELO DeFi remain largely unexploited due to a lack of deep liquidity for fundamental assets and a lack of arbitrage infrastructure. This proposal leverages MEV to align incentives between market makers, the sequencer (later leading to the validators), and searchers, aiming to make it profitable for arbitrageurs and market makers to interact with Celo. This will drive activity, increase sequencer fees, and ultimately improve validator rewards and CELO demand.

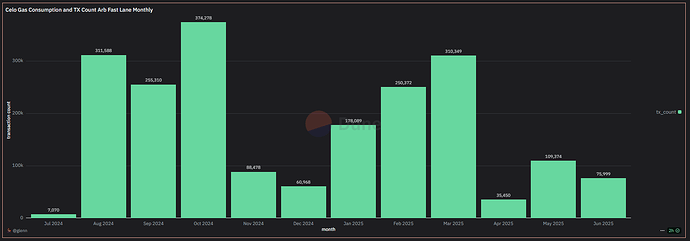

As outlined in our March report, we’ve been running experiments with arbitrage strategies and local stablecoin providers, resulting in consistent monthly volumes and tighter conversion spreads across multiple markets.

So far, Credit Collective has processed over 1.85 million transactions across Carbon DeFi, Aave, and Uniswap, representing a cumulative volume of more than $35 million. We believe there’s a clear path to scaling this activity 10x over the next 12 months.

We propose:

- Deploying $3M into foundational evergreen liquidity pools: CELO/BTC, CELO/ETH, CELO/USDT

- Using $1.6M Credit Collective treasury for long-tail stablecoin pools (cREAL, cCOP, cKES, COPM, BRLA, etc.)

- Build open-source MEV bots for FX arbitrage DEX/DEX and DEX/CEX.

1. Introduction: The FX Market Blueprint

Celo has laid the groundwork for real-world adoption of stablecoins, assets like cCOP, cREAL, cKES, BRLA, and COPM are already gaining traction in payments, savings, and DeFi. But there’s a basic component still missing to bring the Celo market to the efficiency needed.

In traditional FX markets, liquidity and arbitrage form a flywheel: deep liquidity enables arbitrage opportunities, arbitrage tightens spreads and aligns prices, tighter spreads bring more volume, and higher volume incentivizes market makers and LPs to deepen liquidity even further. It’s self-reinforcing.

Depth → Arbitrage → Efficiency → Volume → More Depth

In crypto, this function is typically driven by bot searchers. However, fragmented liquidity and relatively shallow pools have limited the full activation of this dynamic on Celo. We’re facing a classic chicken-and-egg problem: you need liquidity to have arbitrage, and efficient arbitrage to attract liquidity.

So far, players like Credit Collective have focused on growing transaction volume, using multiple cheap liquidity pools (low fees), while significantly increasing volumes, but it hasn’t broken the chicken and egg cycle. We propose shifting the focus to kickstarting the Liquidity <> Arbitrage cycle as the coordination layer between validators, liquidity providers, and searchers

Let’s also be clear: this can’t be solved just by the community recycling its own liquidity. We need external capital. And to attract that capital, we need to create an ecosystem where it’s profitable to participate.

2. MEV: The Hidden Agreement Between LPs and Validators

MEV arbitrage isn’t just a trading strategy; it’s the coordination layer that orchestrates LPs and validator revenue.

There’s an unspoken agreement between LPs and validators:

-

LPs provide liquidity, enabling deep markets.

-

Arbitrage infrastructure generates volume, creating sustainable swap fees.

-

Validators process that volume, earning fees through the sequencer.

The result? Healthy, recurring returns on the three sides.

We think of MEV in three categories:

The Good (Strengthens the system)

-

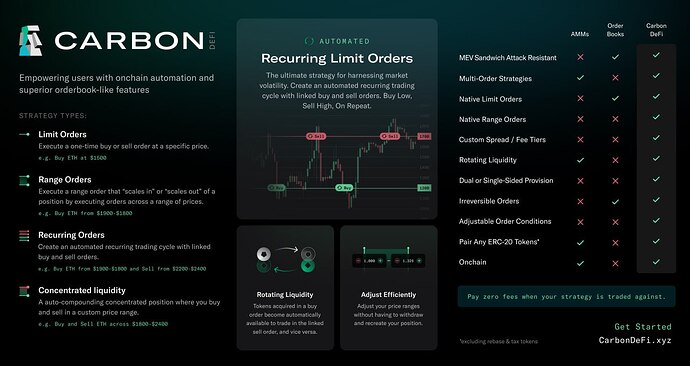

DEX-CEX Arbitrage: Buying low on one market, selling high on another. This aligns prices and improves FX efficiency. This can be DEX/DEX or DEX/CEX

-

Backrunning: Reacting to predictable price shifts (e.g., after a large trade). It improves market responsiveness and depth.

The Bad (Neutral to slightly extractive)

- Liquidation Sniping: Racing to repay loans and claim collateral. Competitive, but keeps lending markets functional.

The Ugly (Actively harmful)

-

Front-running: Bots jump in before a user’s trade, increasing slippage.

-

Sandwich attacks: Bots trade around a transaction, distorting execution - users lose value.

We acknowledge these risks and plan to address them in future discussions. But for now, the key insight is:

Bots, not humans, do most blockchain transactions. These bots keep the system efficient.

And the truth is:

- Most validators/sequencers in the general blockchain space rely on Arbitrage for sustainable revenue.

- Most LPs rely on Arbitrage to stay profitable.

3. Why Arbitrage Matters for PoS Chains

On Proof-of-Stake chains, arbitrage is not just a trading game; it’s a key driver of sequencer revenue, validator rewards, and ultimately network security.

Every swap generates a fee, and arbitrage bots are often the most active source of this volume. They continuously scan for price gaps between DEXs and CEXs, execute profitable trades, and in doing so, generate high-frequency flow that sustains the system.

This creates a flywheel:

- More arbitrage → More transaction volume

- More volume → More sequencer fees

- More fees → Higher sequencer/validators revenue

- More revenue → Can raise rewards for staking

- Higher rewards → More staking

- More staking → Stronger consensus & Demand for Celo

- More demand → More liquidity and arbitrage participation

But again, it only works if deep liquidity exists to support it.

4. Why Arbitrage Matters for Liquidity Providers

Arbitrage isn’t just about validator rewards; it’s also the mechanism that makes providing liquidity profitable and sustainable.

In an ideal world, LPs earn fees from organic trading activity. But in early or fragmented markets, that volume doesn’t appear out of thin air. Bot searchers create the volume.

When arbitrage bots actively trade across pools:

- They generate swap fees for LPs

- They reduce price discrepancies

- They inject high-frequency volume even when user activity is low

This sets off its own flywheel:

- More arbitrage → more DEX volume

- More volume → higher LP revenue

- More revenue → more capital deposited into pools

- Deeper liquidity → more arbitrage opportunities

But again, this flywheel only spins if the infrastructure exists to support searchers.

In ecosystems like Ethereum, Curve, and Uniswap, the top LPs are sustained not by casual traders but by arbitrage flows. Bots are their best customers.

So if we want to attract liquidity to Celo, we need to:

- Bring bots searchers in

- Make arbitrage profitable

- Bring LPs to plug into that volume

5. Strategy overview: Deep Liquidity & Bootstrapping MEV on Celo

Phase 1: Concentrate Liquidity

Deploy $3M across three actively evergreen managed pools (to where most needed) to build liquidity:

- CELO/BTC – $1M

- CELO/ETH – $1M

- CELO/USDT – $1M

- Use the existing $1.6M managed by Credit Collective to maintain long-tail stablecoin liquidity

- Divided into eight $200K pools, each containing $100K of a long-tail stablecoin and $100K of CELO

Why these pools?

- High overlap with centralized exchanges → easier arbitrage.

Create benchmarks for pricing. - Attract Arbitrage infrastructure (bots, routing, analytics).

Why these sizes?

- At this depth, searchers can execute $5K–$20K trades with 10 - 30 bps spreads.

- Expected Arbitrage revenue per pool: $5K - $15K/month. Enough to attract sustained searcher activity.

- Sustained arbitrage means tighter spreads, validator fee capture, and stronger market efficiency.

- This is the size at which the arbitrage flywheel begins to turn.

Once searchers build infrastructure for these pairs, expanding to other assets becomes easier.

Phase 2: Build Searcher Infrastructure for FX Markets

- Build and deploy arbitrage and routing bots - specifically for FX markets, connection between fiat & stablecoins

- Enable private orderflow (relays, direct block submission)

- Optimize gas for block inclusion

- Open-source the work so that others can join in.

Support this with:

- Fast, stable RPC endpoints

- Mempool indexing and access

- R&D grants for FX efficiency development

6. Budget

Requested Allocation:

- $1M – CELO/BTC Pool

- $1M – CELO/ETH Pool

- $1M – CELO/USDT Pool

- $300K – Infra, operations, grants.

- $1.6M – Existing Credit Collective liquidity for long-tail stables

7. Conclusion: Arbitrage infrastructure is the missing Layer for Celo

By aligning incentives between validators, LPs, and arbitrage operators, we can build a robust efficiency layer on Celo.

This is how we turn fragmented, underused markets into seamless, efficient FX rails. This is how we external idle capital into productive liquidity on Celo.

And this is how we position Celo as the chain where the FX market flows across borders, cheaply, transparently, and at speed.

We believe this proposal marks the next evolution of Credit Collective: from a grant-supported initiative to a self-sustaining, evergreen engine powering Celo’s FX layer.

As part of this transition, we’re exploring a new name that reflects this chapter. If you have ideas, we’d love to hear them.

This is intended for public discussion, and we warmly welcome any feedback from the community.

If you have specific recommendations or require any clarification, please don’t hesitate to contact me on Telegram: @tomeriko_textile