I’d like to offer a perspective grounded in technical reality and backed by actual chain data observed since the execution of CGP 169. This is key to refining Celo’s economic system regarding validator rewards and the technical roadmap.

A recurring topic in this and other threads is the adjustment of validator economics.

While well-intentioned, this change would create direct, predictable sell pressure on CELO in the open market. Currently, payments in cUSD would only put pressure on the peg. This results in indirect sell pressure on CELO only when arbitrageurs interact with Mento (cUSD to CELO) or when Mento rebalances its reserve.

Understanding the movement of validator rewards is key here:

- Every epoch, x cUSD is minted fresh for every elected validator, where x is 82.19 (fixed value, see CGP 169) multiplied by their epoch score.

- Equivalent CELO is released from the CeloUnreleasedTreasury to the Mento reserve as collateral backing. This CELO never touches the open market directly.

- Validators claim rewards voluntarily from the ScoreManager.

The current debate centers on the scale and impact of these CELO emissions from the CeloUnreleasedTreasury:

To move from estimates to facts, we must examine actual on-chain data. I have created a publicly available Dune dashboard (with queries) to verify the exact impact of CGP 169 in relation to validator rewards and emissions.

Key findings as of 7th December 2025:

- Total cUSD minted as validator rewards: cUSD 2,145,389

- Approximate CELO collateral backing the rewards: 7,403,584

- Emission savings by RPC Committee: ~68k cUSD

- Validator losses from late epoch transitions: ~60k cUSD

Methodology notes:

- CGP 208 fixed a critical bug affecting precise CELO collateral calculations, so I’m using daily pricing data for approximations. The dashboard queries are open for community review and refinement.

- CGP 169 was executed on March 30th, 2025. We therefore started calculations from the next epoch i.e. 1802 (block 31502680).

- Calculation basis: Circulating supply of 582.15M CELO (same as used by proposers) for consistency in comparisons.

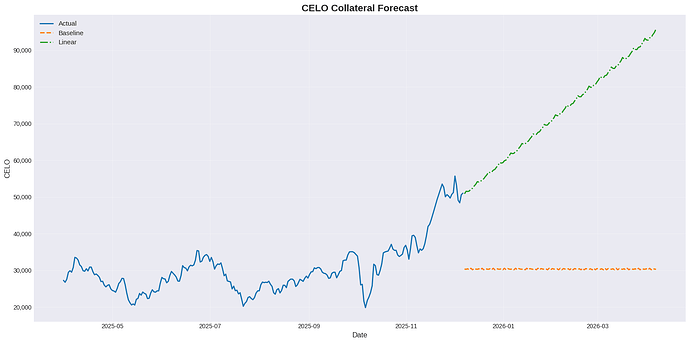

Using this empirical data, we can model a time-series forecast to determine CELO release at different price points.

- Baseline (flat, stable price): With 30k CELO daily collateral (approximate average Celo price of $0.30 through April 2026) this would result in a total annual emission of 11.07M CELO.

- Bear case (linear decline): A linear decline of the CELO price to around $0.09 through April 2026 would result in a total emission of 16.2M CELO.

Under stressed price (bear) conditions, the status quo would achieve an annualized inflation of 2.7% of the circulating supply. While in reality it is expected that the emissions would be significantly closer, if not less, than what is already suggested as an acceptable figure (~2.2%).

While efficiency is always a goal, the data indicates the “crisis-level” figures suggested do not reflect the on-chain reality.