Author(s): Alex_Verda, LuukDAO

Type of Request: Network Decisions & Protocol Improvements

Summary

This proposal calls for reducing the validator set from 110 to 55 to cut token emissions and improve CELO’s supply–demand balance. As Celo now relies on Ethereum for security, a smaller validator set is sufficient and lowers unnecessary costs.

Proposed Changes

Reduce the number of active validators from 110 to 55 and adjust validator election parameters accordingly.

Motivation

Current validator rewards total ~109 cUSD/day per node, or ~$359,700/month for 110 validators. Due to limited cUSD liquidity on CEXs, these rewards are frequently converted to CELO, creating routine sell pressure.

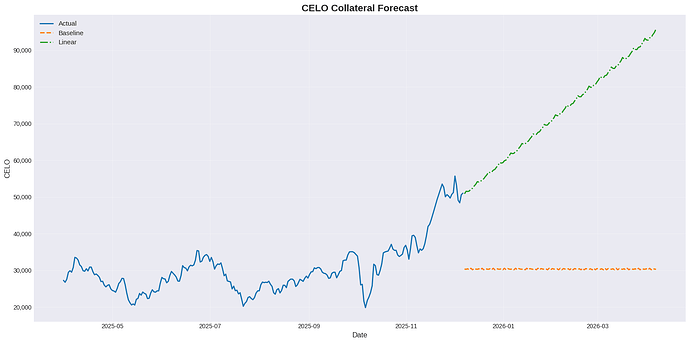

At current CELO prices (~$0.17), this equals ~2.12M CELO/month—an annualized ~4.37% of circulating supply—on top of staking rewards (>4%). With a fixed supply of 1B CELO, this trajectory is unsustainable and could deplete remaining emissions within a decade.

As Celo now inherits security from Ethereum, maintaining the original validator count is no longer necessary. As we don’t have a clear roadmap or short-term need for decentralized sequencing, as described by Marek in this thread, we do not expect the reduction to have any negative impact on the operations of the Celo network.

A reduced set maintains decentralization while lowering emissions to ~2.2% annually, significantly improving tokenomics.

Risks

-

Operational transitions: Validators not elected may exit operations; mitigated through clear communication and predictable timelines set by the Celo Governance process.

-

Future scalability needs: If Celo evolves toward decentralized sequencing, validator requirements may grow; mitigated by retaining the flexibility to scale the set via governance.

**

Useful Links**

(1) Celo Tokenomics Discussion Thread