- Title: Celo Cosmo-Local Credit Network

- ReceiverEntity: Celo Governance

- Status: [DRAFT]

- Author(s): Grassroots Economics; Will Ruddick (@WillRuddick), Mohamed Sohail (@kamikazechaser)

- Type of Request: Funding

- Intent: Season 1

- Funding Category: Regional Community Growth

- Funding Request: $309,000 worth represented in 300,000 cUSD, 30,000 CELO (CELO tokens valued at an average price of $0.3)

TL;DR

Celo Governance to seed 300,000 cUSD and 30,000 CELO to a Global Commitment Pool Fund, governed by a Stewardship Council, disbursed in parametric tranches, to launch a cosmo-local credit network: top-level pool → cascading regional pools → thousands of shops, groups, and projects transacting daily on Celo.

“Commitment in, cUSD out. Trust moves value. From accountable promises to a shared safety net.”

At-a-Glance (Request, Admin, Sustainability)

- Total requested: (300,000 cUSD / 30,000 CELO) held in top-level escrow

- Tranches: Released by parametric triggers (tx/day, fulfillment, utilization)

- Administration (Season 1 pilot): ~20% program overhead across tooling, training, monitoring, and stewardship (see Budget)

- Maintenance (long-term): Minimal swap-fee routed to a pooled Maintenance & Public Goods Fund (no private gain) + partner co-funding; goal is to cover monitoring + ops by Month 12-18

- Future seasons: only if scale targets and new regions are added; core pool can self-maintain once swap volume grows (see Sustainability)

Summary

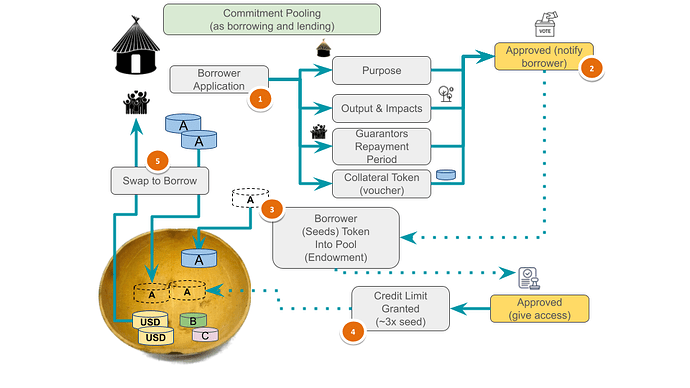

We propose seeding a cosmo-local credit network on Celo: a system of on-chain Commitment Pools that convert local promises (tokenized vouchers) into interest-free, trust-gated credit for small businesses, humanitarian groups, and regenerative projects across the long tail of the real economy. Funding flows from a top-level pool (multi-sig escrow) in tranches, unlocked by parametric triggers tied to on-chain performance (TVL, daily transactions, fulfillment rate), and routed to cascading regional/community pools stewarded by trained champions.

This proposal seeks governance approval under the Season 1 intent of: Regional Community Growth.

Components & Interactions

- Top-Level Escrow: holds cUSD/CELO; releases tranches on KPI proofs.

- Regional/Community Pools: accept issuer ERC20 vouchers as seed; enable interest-free swaps for needed assets.

- Issuers & Guarantors: schools, projects, shops, groups stake their own vouchers; guarantor circles gate trust.

- Oracles & Dashboards: on-chain KPIs (tx/day, fulfillment, utilization) attest tranche unlocks; public dashboards show Financial & Economic TVL.

- Access Layer: Existing smart phone wallets, QR/NFC powered PoS, USSD wallets (no/poor internet connectivity).

Budget & Phasing

Request: 300,000 cUSD (Escrowed, tranche-released)

| Category | Amount | Notes |

|---|---|---|

| Liquidity Buffers (5+ regions) | 80% | escrowed |

| Contracts & Integrations | 5% | registry, pools, escrows, subgraph, audits |

| Training & Onboarding | 5% | ToTs, kits |

| Monitoring & AI Reporting | 5% | DeepGov + dashboards |

| Stewardship Council | 5% | Stewards Governance work |

Request: 30,000 CELO (Escrowed, tranche-released)

| Category | Amount | Notes |

|---|---|---|

| Gas sponsorship | 100% | Onboarding users and businesses |

Phase 1 (0-3 mo): pilot 5 regions, KPI oracles live, first tranche(s).

Phase 2 (3-6 mo): cross-pool routing, inter-regional swaps, fee policy vote.

Phase 3 (6+ mo): expand to additional regions, open forks by aligned partners.

Sustainability (Season 2+)

- Maintenance Fund: swap fee (pool-configurable) routed to a pooled Maintenance & Public Goods Fund; covers monitoring oracles, light stewardship, and community adoption kits.

- Target Coverage: steady-state ops covered when monthly gross swap volume × fee bps ≥ monthly maintenance budget.

- Illustrative math: if monthly swaps reach $1.5M and fee is 5 bps (0.05%), monthly maintenance = $750. Tune bps only if needed; no interest to borrowers.

- Co-funding: regional partners (councils, NGOs, universities) may co-finance training and kits.

- Future seasons: requested only to expand regions or increase buffers; otherwise, maintenance comes from the pooled fund + partners.

Objectives

Key outcomes for Celo:

- Daily transactions: frequent deposits, swaps, and redemptions recorded on-chain.

- Durable TVL: seeded cUSD/CELO remains escrowed; value is mirrored by incoming tokenized commitments (“Commitment in, cUSD/CELO out” with TVL reported as Financial TVL + Economic TVL).

- Mass adoption at the edge: QR Codes, NFC chips and PoS devices at local small businesses, USSD support, festivals/markets onboarding, Tuition fee assistance programmes e.t.c.

- Forkable public goods: open contracts and code, templates, and reporting standards; easy to extend across DAOs, SMEs, and humanitarian partners.

“We are a murmuration, no one survives alone. This network makes cooperation legible and fundable on Celo.”

Why Celo & Why Now

- Long-tail growth: Real-world SMEs, informal groups, and humanitarian circles represent the majority of economic activity but are under-served by DeFi primitives.

- No-interest alignment: Islamic-finance-compatible (no riba), humanitarian-ethics aligned credit.

- Cosmo-local fit: Locally governed pools, globally connected for routing and learning, ideal for Celo’s mission and vision for 2030.

- Coordination Note: We intend to co-design implementation with existing Regional DAOs and welcome a designated seat or liaison in the Stewardship Council.

What We’re Building

1. Top-Level Pool & Stewardship Council

A top-level pool (multi-sig) funds regional/community pools in tranches. Borrowers at this level are regional pool stewards who leave commitments (service vouchers, reporting duties) when drawing cUSD liquidity. Tranches unlock via parametric triggers tied to on-chain KPIs.

Prospective Stewardship Council (subject to confirmation)

- Cauê (Coi) Tomaz (@coi) - Greenpill Brasil

- David Dao (@ddd) - GainForest

- Mohamed Sohail (@kamikazechaser) - Grassroots Economics

- TBD…

Quorum 5/7

Stewardship Council roles and responsibilities:

- Approves tranches

- Reviews monthly and seasonal reports

- Enforce and arbitrate clawbacks

- Ensure forkability and neutrality

The stewardship council acts as an accountability layer providing neutral oversight.

2. Cascading Regional / Community Pools

Regional champions (ToTs) onboard small business networks, humanitarian groups, universities and regenerative projects. Pools are trust-gated via group guarantors and track fulfillment on-chain. Each swap/ redemption generates transactions on Celo.

3. Training & Tooling

- Train the Trainers (ToTs): regional champions in facilitation, pool ops, compliance, reporting.

- Visionary approach: practical playbooks + community storytelling to drive adoption.

- Tooling: voucher registry, pool accounting, QR/alias payments, simple wallet flows, POS integrations, and AI-assisted reporting (DeepGov) for auto-generated dashboards.