Hi,

The Platform Economics team at cLabs has been looking into Celo Epoch Rewards, which have remained unchanged since they were initially proposed 3 years ago in the target schedule. Newer protocols often utilize rewards to incentivize desired behaviors such as adequate staking, DeFi participation, and network usage. Now seems the time to think about if and how rewards should change to incentivize and grow long-term participation in the network. We would like to introduce this topic for community discussion.

Overview

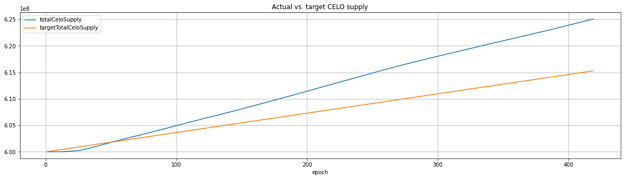

A gap exists between targeted and actual CELO rewarded to date, due to higher participation in validator elections than initially targeted. The total actual rewards at the end of a given epoch result from multiplying the total on-target rewards with a Rewards Multiplier. The Rewards Multiplier started at 100% at epoch 1. By epoch 419, all rewards have already been scaled down to ~87%.

Celo Epoch Rewards

The Celo protocol utilizes Epoch Rewards to incentivize and allocate to the following:

- Voting in validator elections rewards in CELO to support a secure protocol

- Validator rewards in cUSD to sufficiently incentivize secure and performant validators

- Community fund rewards to fund grants that deliver net value to the Celo network

- Carbon offset

- Bolstering the reserve in case of a critical collateralization ratio to support the stability protocol

You can find more on Celo Epoch Rewards in the docs: Epoch Rewards - Celo Docs.

Current state of epoch rewards

- From genesis block to epoch 419, 25.1 million compared to the initially targeted 15.3 million CELO have been distributed as Epoch Rewards

- The protocol takes countermeasures to this growth above target schedule by scaling down all Epoch Rewards with an ever-decreasing Rewards Multiplier, which was ~0.87 for epoch 419.

- CELO locked for voting has been continuously increasing to ~60% (50% target) even with a decreasing Rewards Multiplier (decreasing relative voting reward)

- Rewards have primarily been used to incentivize staking and governance, while other areas of funding have been untapped

- Most of the CELO that has been rewarded to the community fund has not been touched. At the same time, the portion of rewards allocated to the Community Fund hasn’t been enough to launch more ambitious programs

Modification Options

If the current rewarding continues without modifications, the Rewards Multiplier mechanism will further scale down all rewards.

There are two ways to modify this behaviour:

- Adjusting Epoch Rewards parameters to create a stronger drift back to the initial target schedule

- Altering the target schedule to support more epoch rewards

Discussion

- What are the benefits and risks of both options?

- How is the original target schedule perceived relative to the current rewarding? Is the target schedule understood as more of a fundamental truth or as a schedule that can be subject to change over time?

- Many other blockchains use higher reward rates to incentivize user behaviour. How are Epoch Rewards in the Celo networks perceived compared to other blockchains?

Resources

- Epoch Rewards in the docs: Epoch Rewards - Celo Docs

- Epoch rewards data from epoch 0 to 419: https://drive.google.com/file/d/10Y0Du4kxR3cm4SJ5z9QsXT5yXkDmtUuU/view?usp=sharing