I can see a world of this proposal without the MEV part. Let’s divide it into 3 sections:

MEV

Classic Arbitrage

Liquidity Management

The assumption you have here is the same assumption we had when we published this post.

And changed our strategy from private credit to on-chain FX (we understood private credit has a problem with small currencies due to high slippage, so we decided to go after the core problem).

When we found out it simply didn’t work, we went and talked to arbitrage traders and told them:

“Hi, look! You have an arbitrage gap here!” (see the images in the original post on how big the gap is).

What we found out is:

Celo’s general liquidity is too low — the low-hanging fruits are not here (BTC, ETH, USDT to Celo), or at least not deep enough for the companies we talked with to make the effort of coming to Celo.

Small Stablecoins — due to the 2 problems described, even if they come to Celo, the low liquidity and the very long closing cycle of the arbitrage make the liquidity-to-profit ratio not very compelling to them.

So we asked: what’s the minimum depth that will make it time-worthy?

$1m liquidity depth seemed to be a number a few people agreed on as “minimum valid liquidity” for them to make money off so we have a bait to bring them over.

On the smaller stablecoins, sadly it seemed too far for them, especially with the current volumes and depth, with the inherent problems I described above (low liqudity + longs arbitrage cycles).

The experiments we made, both with Mento stablecoins and Minteo stablecoins, brought very significant volumes to both of them. Our experiments combined liquidity providing + simple arbitrage.

See here the post by Mark from Fast Lane (Dex to Dex) & Carbon (a sophisticated market maker), where he describes the results. This was a combination of a grant from CC to them + the liquidity.

So, I understand why MEV sounds scary. Let’s give up on MEV and talk about simple arbitrage — still, I don’t see anyone closing the arbitrage in the current liquidity depth (which honestly might change with Mento’s new FX version, as it will create very deep liquidity with very low slippage).

But last word to do defend the “tipping fees” / “MEV”

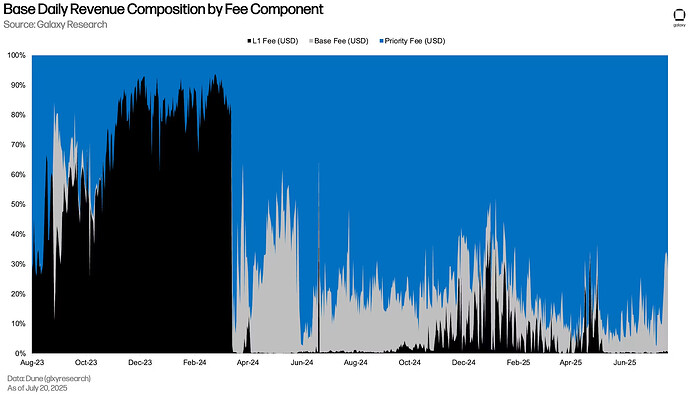

As Celo holders - the revenue of the sequancer - should be important to us - and it’s not discussed enough - see bellow base daily revenue composition by fee component guess what’s in blue, flywheel solutions involve all stake holders.

Ethereum L2 Base Is Thriving on Priority Fees and DEX Activity | Galaxy

About the income:

The assets that are used for liquidity are owned by the governance, just managed by us — meaning going up or down, it belongs to the governance.

The profits from the arbitrage — the goal is to create an open-source, well-documented arbitrage tool that connects Celo’s important endpoints + centralized exchanges, so anyone can activate the bot, keeping no “secret alpha” to ourselves.

Our hope is that this will be our last funding request, and we will become sustainable by operating this arbitrage bot.

It very much reads from your writing that you are coming with open heart and open mind to the discussion. Whatever decision you make, it shows that it came with good intentions and only care for the community, we are flexible to adjust the proposal and make pivots in our strategy, pivots are not a weakness, but the only way to win.