Excellent post and completely agree with building up onchain liquidity for CELO across those three trading pairs (BTC, ETH, and USDT) which are typically the most liquid trading pairs on the majority of CEXs. Not only will this drive more volume and transactions onchain due to CEX to DEX arbitrage but also allow CELO holders to have the ability to buy and sell easily onchain without having to resort to using CEXs only.

When it comes bootstrapping long-tail stablecoin pools, this is something that we believe is important due to Celo having a clear differentiation from other blockchains due to the large variety of world currencies available onchain from Mento and others. Many of these currencies are unique to Celo and are not available anywhere else. This means that for traders that want to have exposure to other currencies outside of USD, Celo is one of the few if not the only blockchain network where they can do so.

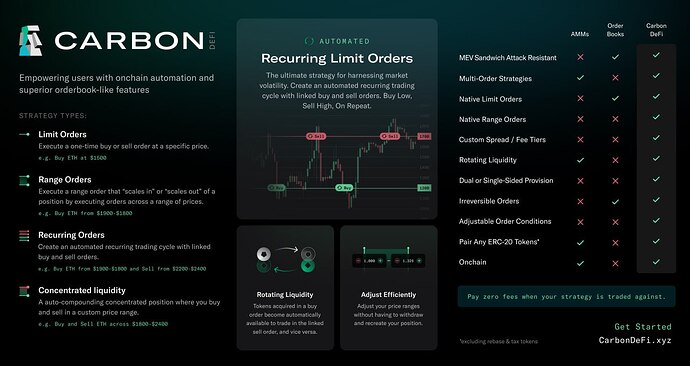

Bancor deployed Carbon DeFi on Celo in ~July 2024 in order to help with some of these efforts as we found prototypical AMMs that offer concentrated liquidity or constant product as not being sufficient for traders looking to make FX markets onchain.

With Carbon DeFi we offer the ability for traders to make markets under any trading pair as long as the respective tokens in the pair have sufficient liquidity onchain (on Carbon DeFi or another onchain trading venue). Under a trading pair, you can quote at a specific price point (limit order) or across a range (i.e. similar to laddering up the orderbook with multiple limit orders between two price points). In essence, for people looking to make markets onchain, Carbon DeFi has the exact same structure as what they are used to when it comes to interacting with centralized solutions and can be considered an onchain orderbook like protocol.

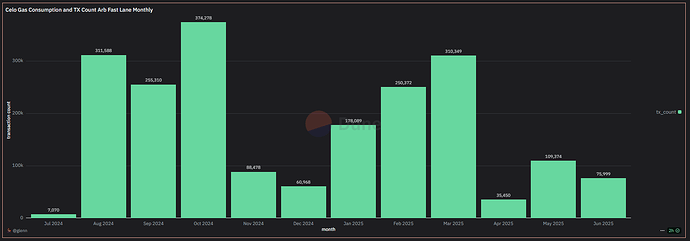

Bancor also deployed the ArbFastLane in conjunction with Carbon DeFi (where traders make markets). The ArbFastLane is an onchain arbitrage framework that fills maker orders on Carbon DeFi against each other and also with other onchain liquidity sources. It also has the ability to close any price discrepancies that exist between liquidity pools on any onchain trading venue outside of Carbon DeFi.

This has led to the Arb Fast Lane performing thousands of transactions on a month by month basis in addition to being a top gas consumer as well:

Transactions per month:

Gas utilized per month:

Gas rank per month in comparison to other smart contracts on Celo

There is a large variety of trading strategies on the Celo deployment of Carbon DeFi

created by traders/liquidity providers/makers and many of these make use of the different world currencies that are available on Celo. We think that this proposal is important and fully support these efforts.