I want to start with my personal belief. I am not an oracle and I do not know the future. Last October’s mass liquidation event wiped nearly $1 trillion from the crypto market, plunging us into severe bear territory. It was arguably the largest deleveraging event in history; a massive portion of leveraged DeFi users were liquidated with estimates suggesting over 2 million accounts went to zero. Market makers and exchanges alike sustained substantial losses.

However, as we look forward in 2026, we are beginning to see signs of life and now is the time to rebuild better.

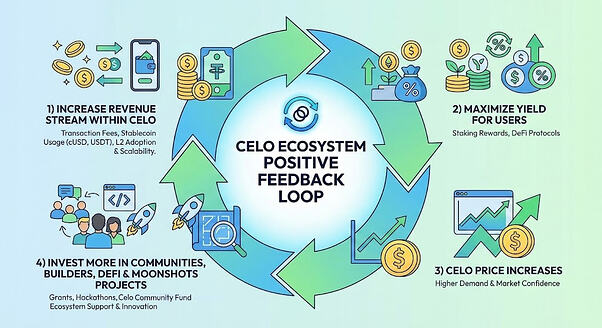

I propose we create a Positive Feedback Loop for the Celo ecosystem driven by four key pillars:

- Increase Revenue Streams within Celo.

- Maximize Yield for Users.

- Drive Celo Price Appreciation (via demand & confidence).

- Re-invest in communities, builders, DeFi and moonshot projects.

1) Increase revenue streams within Celo

a) Stand up a Celo ETH Validator Collective

Lido has become one of the largest fee-generating systems in crypto. As we enter the ETF and DATs era, staking ETH remains a key opportunity but it’s also centralizing around Lido.

Why can’t Celo create its own set of Ethereum validators? It gives us a quadruple advantage:

- Strengthen Celo’s voice and visibility within the Ethereum community

- Generate ETH staking yield for bridged ETH on Celo

- Create a new recurring revenue stream for the ecosystem

- Boost TVL in Celo

Unlike Lido, Celo can offer “yield composability.” By contributing ETH to Celo liquidity pools or Mento CDPs, users could stack additional revenue on top of standard staking yields. This positive feedback loop needs priority. By partnering with institutional staking providers and directly with DATs, we can drastically increase TVL.

b) Strategic Public/Private Partnerships

MiniPay with Opera is a major success story in web3. This partnership template can be used to bring more value-aligned private entities. A prime candidate would be Beast Philanthropy. Since 2020, they have become one of the most effective global giving engines. Celo is uniquely positioned to complement their efforts with the global user base and stablecoins.

Furthermore, last October Beast Financial was registered and their aim is to launch a fintech and crypto app and they’ve been looking for partnerships. This is such a unique opportunity that BMNR invested $200m in Beast Industries in order to have a call option on future products coming from Beast Industries. This is the moment for Celo to step in as the infrastructure partner.

We should propose a strategic partnership where private entities and profitable ecosystem projects commit to holding 1% of their value in CELO (capped at 5% of circulating supply to preserve decentralization). This creates alignment, long-term stability and sustained demand for the token.

c) Re-integrate Mento

Celo’s historical approach was to spin off independent entities (cLabs, Valora, Mento). While this may have helped with operational focus and fundraising perspective, it has unintentionally fragmented our ecosystem and diluted value capture for CELO token holders. With Valora returning to cLabs, we have a precedent for re-consolidation.

It is preferable for the community to rally behind one token rather than fragmenting attention across multiple assets and adding complexity. Getting CELO to $100 with Mento integrated is far more beneficial than trying to legitimize two separate tokens. We need a path to merge Mento back into Celo, where Sequencer and Mento revenues are combined to boost token yields.

I propose a pragmatic revenue-sharing pact to align incentives immediately, without forcing a complex merger on day one and only talk about deeper consolidation if the economics prove out:

Phase 1 (immediate alignment): Mento routes a defined % of fees into the Celo Fee Vault (or uses those fees to buy CELO and route it to the Vault).

Phase 2 (Unified Operations): Align key resources, including liquidity programs, governance coordination, growth budgets and shared dashboards

Phase 3 (Optional Structural Consolidation): if the ecosystem benefits and the terms are fair, explore structural consolidation over time.

It secures the “real yield” narrative for CELO holders immediately. This ensures shared value capture now, while leaving room to navigate the structural details later.

d) Progressive Fee Structure

If we look at payment systems like M-Pesa, low-value transfers dominate by count but large payments dominate by value. Celo can adopt a similar tier structure to M-Pesa.

-

Tier 1: Transactions under $10 keep the current low-fee structure (preserving our mission for financial inclusion).

-

Tier 2: Transactions above $10 incur a slightly higher fee (e.g., 0.05%). If M-Pesa can charge 0.2% and 1%, Celo can certainly capture value on larger transactions without hurting the average user.

The principle: financial inclusion stays protected, while larger / more sophisticated flows contribute proportionally more to the system that secures and runs the network.

2) Maximize yield for users

Celo is one of the most successful blockchains in terms of uptime (zero hacks), real-world usage, and growth rates that surpass most chains. We have sticky global users and native stablecoins, support for USDT and USDC, and offering multiples international currencies through Mento.

The unresolved question is: How does value accrue to token holders? Throughout the world and cultures, gold inspire trust and serve as a reserve currency. Historically, Celo started as “cGold,” implying a reserve asset but people generally tend to look at the previous price action and it is a discouraging view. To regain trust, we must reset expectations by bootstrapping real yield.

Celo has a fixed supply so we must be precise with our tokenomics. Buy-back-and-burn mechanisms work well when supply is uncapped. Furthermore, in a bearish environment, users prefer immediate yield over the theoretical benefits of burning.

I propose that staking rewards be derived from protocol revenue on top of inflation. All burn mechanisms should be cancelled and those fees routed to a Celo Fee Vault (an on-chain smart contract) that tops up Celo staking yield. It receives net protocol revenue and then distributes it transparently:

- Target: 6% of the 700m circulating supply (approx. 42m CELO/year).

- Split (for a later stage): 4% for Staking Rewards, 2% for Governance Participation.

This mechanism incentivizes locking CELO. As the percentage of locked tokens drops, the APR for those who do lock increases dynamically:

- 10% of circulating supply - 70m locked Celo - 60% APR

- 40% of circulating supply - 280m locked Celo - 15% APR

- 70% of circulating supply - 490m locked Celo - 8.57% APR

Benefits:

- No Speculation Required: The mechanism works without assuming price appreciation.

- Scales with growth: Value capture scales with real revenue.

- Simple Narrative: “More usage = More yield.” Network growth is directly tied to token holders’ benefits.

This is how we rebuild trust: not by promising a fixed APR, but by making the mechanism simple and tied to real network economics.

This is a strategy draft but we should still define what “working” looks like. A simple scorecard could look like this:

-

Vault inflows: reach $X/month within Y months (net of L1 costs).

-

Staked CELO: rise from A% to B% of circulating supply (or “active stake”) over Y months.

-

Net revenue to stakers: Y% of sequencer/protocol net revenue distributed via the Vault (once implemented).

-

Mento growth: Z% TVL growth in Mento markets and/or stablecoin supply growth (paired with fee contribution into the Vault).

3) Celo price increases

While focusing solely on price can feel taboo, these mechanics are designed to make holding CELO logical. A clear value capture mechanism creates demand, translating user growth into holder value. This should be visualized on a public dashboard (e.g., mondo.celo.org) to display APR and nudge governance participation. Price recovery restores confidence and provides the resources needed to fund our vision.

4) Re-Invest in the Ecosystem

A higher CELO price extends the runway for everyone. It allows us to invest more heavily in communities, builders, DeFi protocols and moonshot projects, closing the loop and starting the cycle again.

This proposal is a starting point. We possess the technology and the mission; now we must build the economic engine to match. I invite the community, developers, validators and holders to critique these mechanisms, challenge the assumptions and refine the numbers. Let’s work together to turn these ideas into actional steps that ensures the next chapter of Celo.